Foreign Institutional Investors (FIIs) play a huge role in shaping the Indian stock market. They invest large sums of money, and their actions often move prices, influence trends, and shift overall sentiment. For individual traders, tracking what FIIs do can give valuable clues about where the market might go next.

What is FII Data?

FII data shows how much foreign investors are buying or selling in the Indian stock market. This data is updated daily and highlights whether FIIs are net buyers or sellers.

When they sell heavily, it often hints at caution or a weak outlook.

For example, FIIs sometimes pull back due to global issues like changes in US interest rates or international trade tensions. These patterns help Indian investors understand global sentiment and adjust their strategies accordingly.

How to Use FII Data for Trading Ideas?

Using FII data through a stock screener helps identify market trends by tracking foreign institutional investors’ buying and selling activities.

1. Watch Net Inflows and Outflows

A consistent buying spree of foreign institutional investors means that momentum is moving in a positive direction. On the other hand, if the trend shows that they are continuously selling, it usually indicates that a correction is about to happen.

Example: Suppose FIIs are divesting the tech sector while buying the banking one, this could indicate that technology is going to weaken while finance will continue to strengthen.

2. Spot Short-Term Trends

Capturing daily capital movements is very instrumental in understanding short-term market trends. One of the features that frequently heralds the beginning of a rally is the buying activity of FIIs for a number of days. On the contrary, sustained selling may warn of limited selling pressure in the near term.

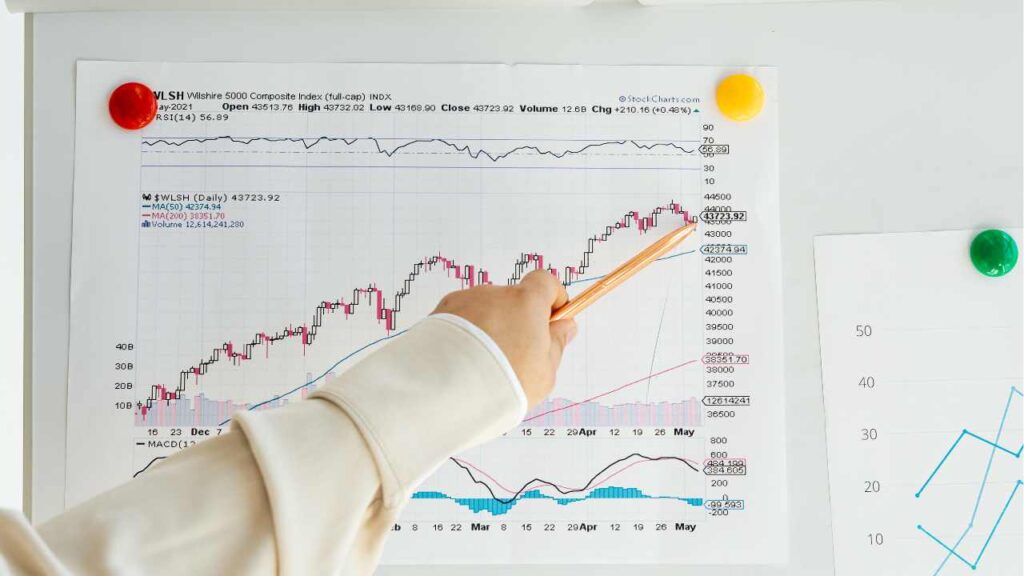

Example: When FIIs abruptly start loading up on stocks in a particular industry, traders can expect a short-term uptrend. Technical instruments like RSI or MACD can be used for confirmation of the trade.

3. Identify Sector Rotations

Institutional investment decisions do not occur in isolation. They gradually divest one area of their portfolio to increase their stake in a new sector. This kind of behaviour opens up the gates for discovering future gems.

Example: A continuous growth of FII investments in the banking sector might be a signal of getting back the trust in financial services.

4. Understand Market Sentiment

FII data is also an emotional barometer. Massive purchases depict a positive outlook; however, sustained sales may be a caution or fear. Traders can recalibrate their portfolios accordingly.

Example: In case of a prolonged period when FIIs sell large-cap stocks, investors may redirect their attention to sectors that are less vulnerable to domestic demand, like FMCG or energy.

Conclusion

FII data is not just a set of figures but rather a reflection of their perspective. It assists traders in knowing where huge amounts of money are heading and which sectors are picking up.

Nevertheless, keep in mind: FII trends are only part. Combine them with research. FII data can be a useful tool when applied appropriately to recognise trends in time, make sound decisions, and be ahead of the competition in a volatile market.