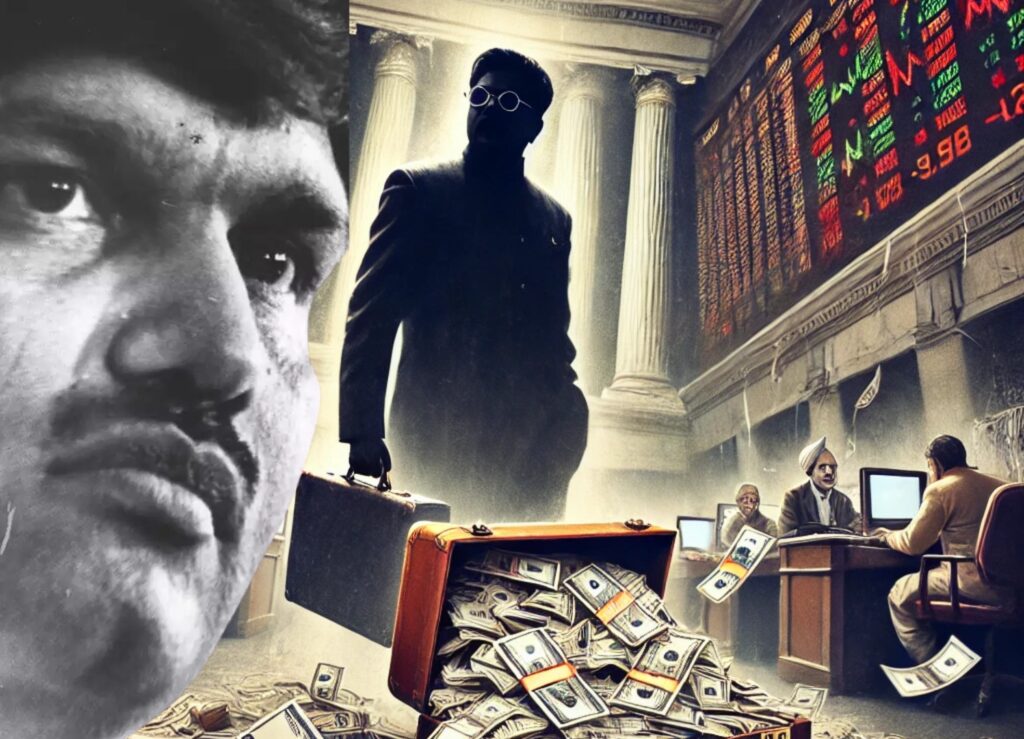

The Harshad Mehta scam is one of the most infamous financial scandals in India’s history. Known as the “Big Bull of Dalal Street,” Mehta masterminded a scheme that shook the very foundations of the Indian financial system. With an estimated fraud amount of ₹4,000 crore (approximately $1 billion at the time), it’s crucial to understand how this scandal unfolded and its enduring impact. Keywords like “Harshad Mehta scam amount in rupees,” “Harshad Mehta total scam amount,” and “how much money was scammed in 1992” shed light on this financial debacle that changed India forever.

Background: Harshad Mehta’s Rise

Before the 1992 scam, Harshad Mehta was celebrated as a stock market genius. Coming from a humble background, Mehta worked his way up to become a renowned stockbroker. His strategy of picking undervalued stocks and creating demand earned him a reputation as a financial wizard. At a time when India’s stock market was gaining traction, Mehta’s aggressive strategies seemed revolutionary.

However, the Indian financial system of the early 1990s was plagued with inefficiencies and loopholes. With limited regulatory oversight, it provided fertile ground for someone like Mehta to exploit its vulnerabilities.

The Mechanics of the Scam

Exploitation of Banking Loopholes

Mehta’s fraud centered around the misuse of Bank Receipts (BRs) and Ready Forward (RF) deals. BRs, essentially promissory notes between banks, were intended to facilitate short-term lending. Mehta manipulated these instruments by creating fake BRs to siphon funds from banks. These funds were then funneled into the stock market.

Stock Price Manipulation

With the illicit funds at his disposal, Mehta purchased shares in select companies in massive volumes. This artificial demand drove up stock prices exponentially. For example, ACC’s share price skyrocketed from ₹200 to nearly ₹9,000, representing an astonishing 4,400% increase. Investors, seeing the rise in prices, jumped on the bandwagon, further inflating the bubble.

Unveiling the Fraud

The scam began to unravel when investigative journalist Sucheta Dalal exposed Mehta’s dubious activities in a series of articles. The revelations highlighted how he had misused the banking system to fund his stock market exploits. As the truth came to light, the stock market experienced a massive crash, wiping out investor wealth and eroding public confidence.

Impact on the Stock Market and Economy

The immediate aftermath of the scam was devastating. The Bombay Stock Exchange (BSE) lost nearly half its value as panic selling ensued. Thousands of investors suffered significant losses, and the market’s credibility was severely damaged. The scam also exposed the fragility of India’s banking sector, which faced immense scrutiny in the years that followed.

Legal and Regulatory Aftermath

Legal Proceedings

Harshad Mehta faced numerous charges, including cheating, forgery, and criminal conspiracy. He was arrested in 1992, and over the years, he was convicted in multiple cases. However, Mehta’s life ended abruptly in 2001, when he suffered a fatal heart attack while in custody.

Regulatory Reforms

The 1992 scam served as a wake-up call for India’s financial regulators. The Securities and Exchange Board of India (SEBI) was granted more powers to oversee and regulate the stock market. New rules were introduced to increase transparency, improve accountability, and prevent market manipulation.

Personal Reflections: Lessons from the Scam

The Harshad Mehta scam offers several lessons for investors and regulators alike. First, it underscores the importance of due diligence. Blindly following market trends can lead to disastrous consequences, as many investors learned in 1992. Second, it highlights the need for robust regulatory frameworks to ensure the integrity of financial systems.

As someone with a keen interest in financial history, exploring this case has deepened my appreciation for the need for ethical practices in the stock market. Trust and transparency are the cornerstones of any financial system, and the Harshad Mehta scam remains a stark reminder of what happens when they are compromised.

Cultural Depictions

The scam’s notoriety has made it a subject of fascination for the media. The web series “Scam 1992: The Harshad Mehta Story” dramatized the events and became a massive hit, bringing the story to a new generation. By highlighting both Mehta’s brilliance and his flaws, the series serves as both a cautionary tale and a riveting narrative.

Conclusion

The Harshad Mehta scam is more than just a tale of financial fraud. It’s a story of ambition, greed, and the systemic vulnerabilities that allowed one man to manipulate an entire financial system. With a total scam amount in rupees reaching ₹4,000 crore, the scandal’s impact continues to resonate. By learning from the past, we can strive to build a more transparent and resilient financial future.

How much money was scammed in 1992? Enough to shake a nation. But with vigilance and reform, such episodes can be consigned to history, serving only as lessons for generations to come.